When you open a Retirement Savings Account (RSA), your money doesn’t just sit in a vault. It’s actively invested on your behalf to help it grow. But how is it invested? And do you have a say in the process?

The answer lies in something called the Multi-Fund Structure, a framework created by the National Pension Commission (PenCom) to give you more control over your financial future.

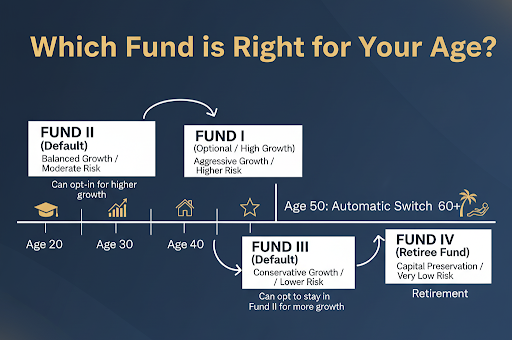

If you’ve ever looked at your pension statement and wondered what “Fund II” or “Fund III” means, this article is for you. We will demystify the pension fund types in Nigeria and help you understand which one is perfectly suited for your stage in life. This knowledge is crucial because choosing the right fund can significantly impact how much you have when you retire.

What is the Multi-Fund Structure?

Think of the Multi-Fund Structure as different shoes for different occasions in your wardrobe – your sneakers for running, your nice leather shoes for owambe and so on. Instead of a “one-size-fits-all” approach, it divides the pension funds into different categories, each with its own investment strategy, risk level, and growth potential.

The core idea is simple: your age and how close you are to retirement should determine how your money is invested. A younger person has more time to recover from market ups and downs, while someone nearing retirement needs to protect their savings.

The Four Main Funds: A Simple Analogy

Let’s compare the main active funds to different types of vehicles. Each one is built for a different speed and purpose.

- Fund I: The Sports Car (High Growth, Higher Risk) This is the most aggressive fund, with a significant portion (up to 75%) invested in variable instruments like stocks and equities. Like a sports car, it’s built for speed and high performance, offering the potential for the highest returns. However, it also comes with a bumpier ride (higher risk).

- Who is it for? Strictly for contributors below 50 who have a high-risk appetite and proactively opt-in. You must formally request to be in this fund.

- Fund II: The Sedan (Balanced Growth, Moderate Risk) This is the default fund for most young and mid-career professionals. It’s like a reliable sedan—it balances performance with safety. It has a healthy mix of growth assets (like stocks) and more stable, income-generating assets (like bonds). It’s designed for steady, long-term growth.

- Who is it for? It is the default fund for all active contributors aged 49 and below.

- Fund III: The SUV (Conservative Growth, Lower Risk) As you get closer to retirement, your priority shifts from aggressive growth to capital preservation. Fund III is like a sturdy SUV—safe, stable, and designed to protect its passengers. It has a much lower allocation to stocks and a higher concentration in fixed-income securities.

- Who is it for? The default fund for active contributors aged 50 and above.

- Fund IV: The Armoured Vehicle (Capital Preservation, Very Low Risk) This fund is exclusively for retirees. Its primary goal is not growth, but to protect the capital and provide a steady stream of income. Think of it as an armoured vehicle—its main job is to keep the assets safe. It has minimal to no exposure to the volatility of the stock market.

- Who is it for? Strictly for retirees who are drawing down on their pension.

Which Pension Fund Should I Choose?

The system is designed to be intuitive, automatically placing you in a fund based on your age. However, you do have choices.

This visual guide makes it easy for anyone to see where they fit. Younger earners start in the balanced Fund II but can choose the more aggressive Fund I. Once you turn 50, you are automatically moved to the more conservative Fund III, but you can elect to move back to Fund II if you have a higher risk tolerance.

Building Authority and Trust with Parthian Pensions

Understanding the PenCom multi-fund structure is the first step toward taking active control of your retirement savings. It’s not just about contributing monthly; it’s about ensuring your money is working as hard as it can for you at every stage of your life.

As your financial partner, we are committed to not just managing your funds, but also empowering you with the knowledge to make confident financial decisions.

Want a deeper dive into how these funds are structured and how they perform?

Learn more about our investment strategy on our “Multi-Fund Structure Explained” page.