- Home

- About us

Who we are

Discover Parthian journey, key milestones, & evolution.

Our guiding principles and future aspirations.

The bedrock of our operations and culture.

Leadership and impact

Meet the experienced leaders guiding our strategy.

The dedicated professionals managing our operations.

Our commitment to empowering underserved communities with financial literacy

Partners

Proud member of a leading financial services group.

Committed to compliance and industry best practices.

Who we are

Discover Parthian journey, key milestones, & evolution.

Our guiding principles and future aspirations.

The bedrock of our operations and culture.

Leadership and impact

Meet the experienced leaders guiding our strategy.

The dedicated professionals managing our operations.

Our commitment to empowering underserved communities with financial literacy

Partners

Proud member of a leading financial services group.

Committed to compliance and industry best practices.

- Products & Services

Retirement Savings Account (RSA)

Secure your future; start online today.

Seamlessly move your account to Parthian.

Boost your savings; grow your pension.

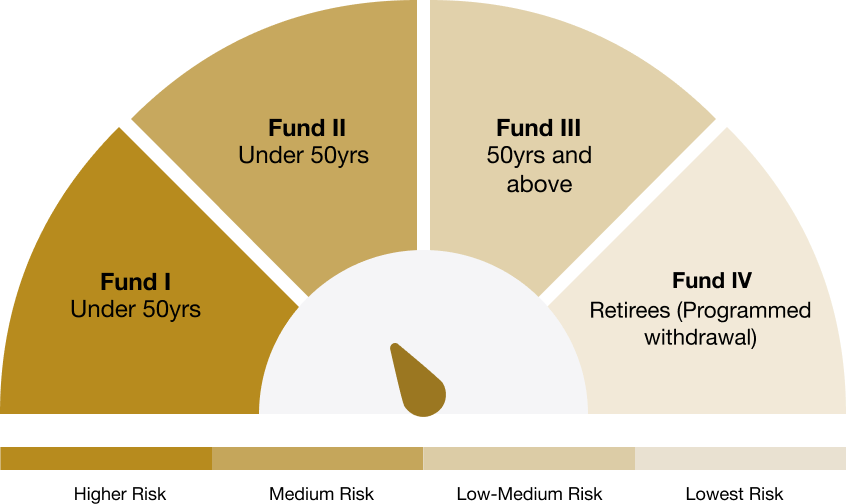

Understand and choose your investment funds.

Understand and choose your investment funds.

Specialized Plans & Services

Pension solutions for the informal sector.

Dedicated support & Services for retirees.

Invest in line with your values

Tailored pension schemes for corporates.

Guidance on transferring NSITF funds.

- Resources

Plan & Track

Project savings and plan your future

View latest fund prices and history.

Detailed breakdown of investment allocations.

Learn & Understand

Articles, videos and financial guides.

Quick answers to common questions.

Dymestify pension industry jargon.

Guidance ontransferrinf NSITF funds.

Documents & News

Forms, reports and brochures

Latest updates and company news.

Forms, reports and brochures.

Plan & Track

Project savings and plan your future

View latest fund prices and history.

Detailed breakdown of investment allocations.

Learn & Understand

Articles, videos and financial guides.

Quick answers to common questions.

Demystify pension industry jargon.

Guidance on transferring NSITF funds.

Documents & News

Forms, reports and brochures

Latest updates and company news.

Forms, reports and brochures.

- Benefit Administration

Explore Your Benefit Options

– Programmed Withdrawal Explained

– Understanding Annuity OptionsUse your RSA to help buy your home.

Criteria & Process.

Clear guidance for Next of Kin

Eligibility criteria and how to apply

Accessing Benefits & Support

Find our physical office locations near you.

Answers to common benefit queries.

Explore Your Benefit Options

– Programmed Withdrawal Explained

– Understanding Annuity OptionsUse your RSA to help buy your home.

Criteria & Process.

Clear guidance for Next of Kin

Eligibility criteria and how to apply

Accessing Benefits & Support

Find our physical office locations near you.

Click to download retirement packs.

Answers to common benefit queries.

- Contact us

Direct Support & Enquiries

Have a question? Reach out via form, email, or phone.

– Online Contact Form

– Email Us: info@parthianpensions.com

– Call us: 0800-PARTHIANGet instant help or find answers quickly.

– Live Chat (Mon-Fri, 9am-5pm)

– Visit Our FAQSLocations, Feedback & Social

Find our physical office locations near you.

- Parthian Pensions

- Parthian Pensions

- Parthian Pensions

- Parthian Pensions

- Parthian Pensions

- CALL 0700-00-PARTHPEN

- Home

- About us

Who we are

Discover Parthian journey, key milestones, & evolution.

Our guiding principles and future aspirations.

The bedrock of our operations and culture.

Leadership and impact

Meet the experienced leaders guiding our strategy.

The dedicated professionals managing our operations.

Our commitment to empowering underserved communities with financial literacy

Partners

Proud member of a leading financial services group.

Committed to compliance and industry best practices.

Who we are

Discover Parthian journey, key milestones, & evolution.

Our guiding principles and future aspirations.

The bedrock of our operations and culture.

Leadership and impact

Meet the experienced leaders guiding our strategy.

The dedicated professionals managing our operations.

Our commitment to empowering underserved communities with financial literacy

Partners

Proud member of a leading financial services group.

Committed to compliance and industry best practices.

- Products & Services

Retirement Savings Account (RSA)

Secure your future; start online today.

Seamlessly move your account to Parthian.

Boost your savings; grow your pension.

Understand and choose your investment funds.

Understand and choose your investment funds.

Specialized Plans & Services

Pension solutions for the informal sector.

Dedicated support & Services for retirees.

Invest in line with your values

Tailored pension schemes for corporates.

Guidance on transferring NSITF funds.

- Resources

Plan & Track

Project savings and plan your future

View latest fund prices and history.

Detailed breakdown of investment allocations.

Learn & Understand

Articles, videos and financial guides.

Quick answers to common questions.

Dymestify pension industry jargon.

Guidance ontransferrinf NSITF funds.

Documents & News

Forms, reports and brochures

Latest updates and company news.

Forms, reports and brochures.

Plan & Track

Project savings and plan your future

View latest fund prices and history.

Detailed breakdown of investment allocations.

Learn & Understand

Articles, videos and financial guides.

Quick answers to common questions.

Demystify pension industry jargon.

Guidance on transferring NSITF funds.

Documents & News

Forms, reports and brochures

Latest updates and company news.

Forms, reports and brochures.

- Benefit Administration

Explore Your Benefit Options

– Programmed Withdrawal Explained

– Understanding Annuity OptionsUse your RSA to help buy your home.

Criteria & Process.

Clear guidance for Next of Kin

Eligibility criteria and how to apply

Accessing Benefits & Support

Find our physical office locations near you.

Answers to common benefit queries.

Explore Your Benefit Options

– Programmed Withdrawal Explained

– Understanding Annuity OptionsUse your RSA to help buy your home.

Criteria & Process.

Clear guidance for Next of Kin

Eligibility criteria and how to apply

Accessing Benefits & Support

Find our physical office locations near you.

Click to download retirement packs.

Answers to common benefit queries.

- Contact us

Direct Support & Enquiries

Have a question? Reach out via form, email, or phone.

– Online Contact Form

– Email Us: info@parthianpensions.com

– Call us: 0800-PARTHIANGet instant help or find answers quickly.

– Live Chat (Mon-Fri, 9am-5pm)

– Visit Our FAQSLocations, Feedback & Social

Find our physical office locations near you.

- Parthian Pensions

- Parthian Pensions

- Parthian Pensions

- Parthian Pensions

- Parthian Pensions

- CALL 0700-00-PARTHPEN