Congratulations! You’ve reached a significant milestone: retirement. After decades of hard work and consistent saving, the moment has arrived to access the funds you’ve diligently built in your Retirement Savings Account (RSA).

Now, you face one of the most important financial decisions of your life. The big question is not if you will get your money, but how you want to receive it. As you prepare to access your pension at retirement, you’ll find that the National Pension Commission (PenCom) provides two primary options for receiving your periodic payments after your initial lump sum.

These two PenCom retirement options are Programmed Withdrawal (PW) and Annuity.

They are both excellent choices, but they work very differently. Understanding the distinction is crucial to selecting the path that best aligns with your personal financial goals, risk tolerance, and family needs. This guide provides a balanced, clear comparison to help you make an informed decision.

What is Programmed Withdrawal (PW)?

Programmed Withdrawal is a method where you receive a regular income (monthly or quarterly) directly from your Pension Fund Administrator (PFA), like Parthian Pensions.

Here’s how it works:

- Your Funds Remain Invested: Your remaining RSA balance is transferred to our Retiree Fund (Fund IV), where it continues to be professionally managed and invested. This means your capital still has the potential to grow.

- Payments are Calculated: Your periodic payment is calculated based on your total RSA balance, expected lifespan, and the anticipated growth of your funds. These payments are reviewed periodically and can be adjusted.

- You Can Leave a Legacy: A key feature of PW is that upon your passing, the entire remaining balance in your RSA is paid to your named beneficiary or next of kin.

What is an Annuity?

An Annuity is a financial product you purchase from a licensed Life Insurance company.

Here’s how it works:

- You Purchase a Policy: You use a portion of your RSA balance to buy an annuity policy. This amount is then transferred from your PFA to the insurance company of your choice.

- Guaranteed Income for Life: The insurance company, in return, guarantees to pay you a fixed, regular income (monthly or quarterly) for the rest of your life, no matter how long you live. This eliminates the risk of outliving your savings.

- Inheritance Depends on the Policy: Typically, with a standard Life Annuity, the payments cease upon death. However, you can opt for special types of annuities (like a Guaranteed Term Annuity) that may offer a provision for beneficiaries, often at a higher initial cost.

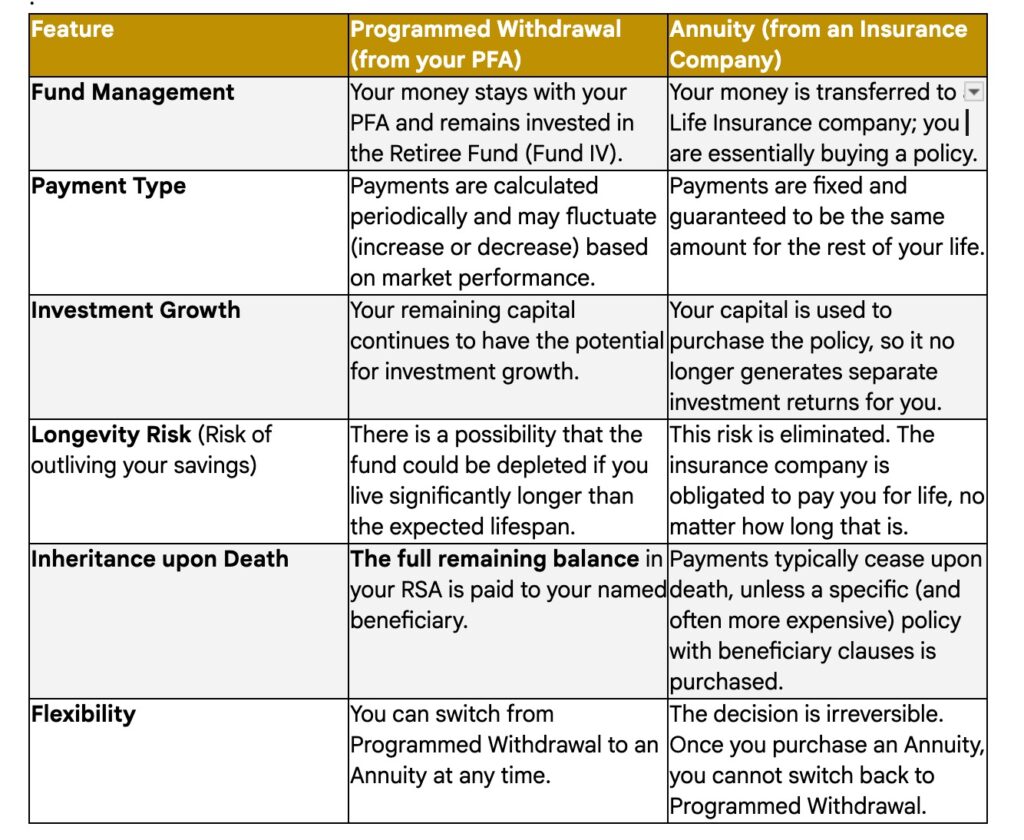

The Head-to-Head Comparison: Programmed Withdrawal vs. Annuity

To make the choice clearer, let’s compare the key features of these two options side-by-side

So, Which Option is Right for You?

There is no single “best” answer. The right choice depends on your personal circumstances and what you value most. Ask yourself these questions:

You might prefer Programmed Withdrawal if:

- Leaving a financial legacy for your children or other beneficiaries is a top priority.

- You want your savings to continue growing through investments.

- You are comfortable with the idea that your income might fluctuate slightly over time.

You might prefer an Annuity if:

- Your highest priority is the absolute certainty of a fixed income that will never run out.

- You are risk-averse and want to protect yourself against outliving your savings.

- Leaving a large inheritance from your pension is less of a concern.

Your Retirement, Your Choice

Choosing between Programmed Withdrawal vs. Annuity in Nigeria is a significant decision that shapes your financial life in retirement. Take your time, assess your priorities, and speak with your loved ones.

As your PFA, our commitment is to provide you with all the information and support you need to make the choice you are most comfortable with. We are here to guide you through the process, ensuring a smooth transition into the next chapter of your life.

Ready to explore your options further?

Learn more about your Retirement Benefits and the application process with Parthian Pensions.